In this article, we'll cover:

What is Competitive Intelligence?

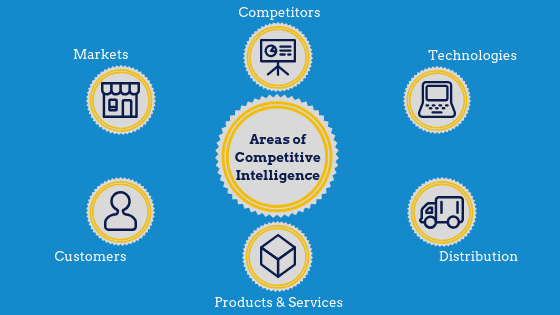

Competitive intelligence (CI) is a core part of any business strategy. It involves collecting and analysing information surrounding a company’s market—including its competitive environment, competitor’s products and customer base, and strategies.

Gathering the information is only one small part of good Competitive Intelligence research—the key to making the best-informed decisions lies in what you do with the data you’ve collected.

Effective CI is all about taking a deep dive into your industry’s competitive landscape. Using your in-house team of CI and industry experts or your sales team to help you carry out the necessary market research will enable you to gain an in-depth understanding of competitive information.

Essentially a form of market intelligence, developing an awareness of your competitor’s latest products, launches, and lifecycle marketing strategy will give you a competitive advantage. It will lead to more strategic decision-making within your business and, thereby, allow you the potential to grow your market share.

Far from a new concept, the first Competitive Intelligence organisation was founded in 1972 and called The Society of Competitive Intelligence Professionals (SCIP). The organisation still exists today and consists of a board of business intelligence professionals across all industry verticals. Renamed Strategic and Competitive Intelligence Professionals in 2010, the group shares analytical and research tools at its yearly summits and conferences.

How Competitive Intelligence works

Unlike corporate espionage, Competitive Intelligence involves collecting information ethically from both published and unpublished sources such as:

- Online searches (competitor’s websites, job postings, business information aggregators, your competitor’s social media platforms)

- Press releases

- Your sales team (they’ll gather information organically when one calls to prospective customers)

- Those who attend industry events, conferences, and trade shows

- Vendors and distributors who are involved in your industry and perhaps serve a competitor

- Competitors themselves (whether you choose to go about this overtly or a little more covertly is based on the competitor intelligence strategy you’re planning to execute)

It’s crucial to remember that effective Competitive Intelligence goes beyond your in-house data—otherwise, you’ll just be doing everyday market research. To complete a Competitive Intelligence report, it’s key to look outside your company and all your external sources.

This way, you’ll be able to paint a much more detailed picture of your overall industry, anticipating possible threats and opportunities before they arise to give your business a competitive edge.

Effective CI can also have a knock-on effect on other areas of your business, improving customer and contact centre experience if you happen to unearth successful competitor marketing tactics. Performing regular CI will keep your business ahead of the game, allowing you to stay on top of trends and use the data you’ve collected to create even better business practices.

Types of Competitive Intelligence

When performing a CI report, there are plenty of paths to take. It’s vital to remember when sourcing the data that while you aim to produce a competitive analysis, you need to be benchmarking your competencies and failures against those of your competition to get the most out of the process.

We’ve compiled a list of some of the types of Competitive Intelligence your business should explore when performing a CI report:

1. Pricing

Keeping on top of your competitor’s pricing is a core part of effective CI research. Changes in pricing can have a significant impact on customer retention and churn levels. So maintaining a knowledge of which businesses in your industry have higher or lower prices will help inform your own pricing decisions.

You might claim to have the best ROI in the market, but unless you’re performing regular CI, you won’t be able to pinpoint fluctuations or changes in pricing within your industry.

You can source pricing information easily on competitors’ websites, but you should also make sure to read customer reviews centred around pricing and monitor the responses. This will enable you to see whether your ROI really is unbeatable and whether you’re losing out to the competition because of your pricing.

2. Competitor news coverage

Keeping an eye on news coverage in your industry will inform you of any changes in marketing strategies that your competitors might be using. Your CI report shouldn’t just focus on the positive coverage, though; negative news coverage is just as critical to unearthing fundamental shifts in strategies.

If a competitor gets positive coverage on a new product launch, this could indicate a change in brand strategy. If this new strategy seems effective and wins the business more customers, you might consider implementing a similar strategy yourself.

Likewise, if a competitor gets negative coverage due to some data breach, you could use this as an opportunity to detail your strict security measures to prospective customers.

3. Competitor websites

Scouring competitors’ websites will give you an overview of any new tools they have on display, such as CTA buttons or a live chat option. If you can tell that competitors are starting to up their game by implementing new features such as chat-bots or gamified experiences, this could indicate a strategy shift towards improving the customer experience. And it would help if you adapted your strategy to keep up.

4. Customer reviews

Sourced from either your competitor’s site directly or third-party websites, analysing customer reviews is an accessible way to identify any potential gaps or areas for improvement in your industry. If you’re in the clothing industry, for example, you might find that one of your competitors doesn’t sell any clothes for plus-size women or that customers want a more straightforward returns process—this is a gold mine of opportunity.

Use the data you’ve collected to inform your own business practices so you can start regaining your CX edge and create a shopping experience that puts customer satisfaction at the heart of its strategy.

Uses of Competitive Intelligence

As a competitive strategy, CI will help keep your business ahead of the curve. Combined with strategic intelligence and Competitive Intelligence tools for analysing data, you’ll be able to improve your own CX and company as a whole. The benefits and uses of CI don’t stop there, so make CI a part of your wider strategy to:

-

Anticipate competitor’s next moves

By undertaking CI and performing a competitor analysis, you’ll be able to keep track of potential opportunities and threats in your industry. Anticipating your competitor’s next moves will give you an advantage and enable you to either implement strategies before they do or turn things on their head to stand out from the crowd.

Perhaps your industry is coming under fire for lack of data privacy. By performing CI, you’ll be able to anticipate what your competitors might do in response and either align with them or position yourself differently to make a point.

-

Stay ahead of the game.

Carrying out Competitive Intelligence research may take time, but you’ll reap the benefits by always staying ahead of the game. To succeed, you need to appeal to consumers and their desires in an ever-evolving market (a new market itself might even pop up). Use CI to figure out which competitors in your industry aren’t taking specific desires or trends into consideration and be the one to incorporate these into your business instead.

-

Lead to strategic decision-making

Data is the cornerstone of an effective competitive intelligence strategy, so it’s only natural that this would lead to more strategic decision-making. As you venture on your CI journey, you’ll find that you must support your decisions with data to be successful.

Competitive Intelligence clarifies the importance of hard data and will help you make better decisions based on fact rather than mere prophecy. If the data you’ve collected during CI signals a gap in your market, it’s your job to close the gap and implement strategies that bring something new to the industry.

The Key to a Successful Competitive Intelligence Program

A successful Competitive Intelligence program relies on effective tools for collecting and analysing data. There are many metrics available that you can use to run a successful CI program and help you navigate the waters if you’re a beginner. Some useful tools and strategies to ensure the application of a solid CI program include:

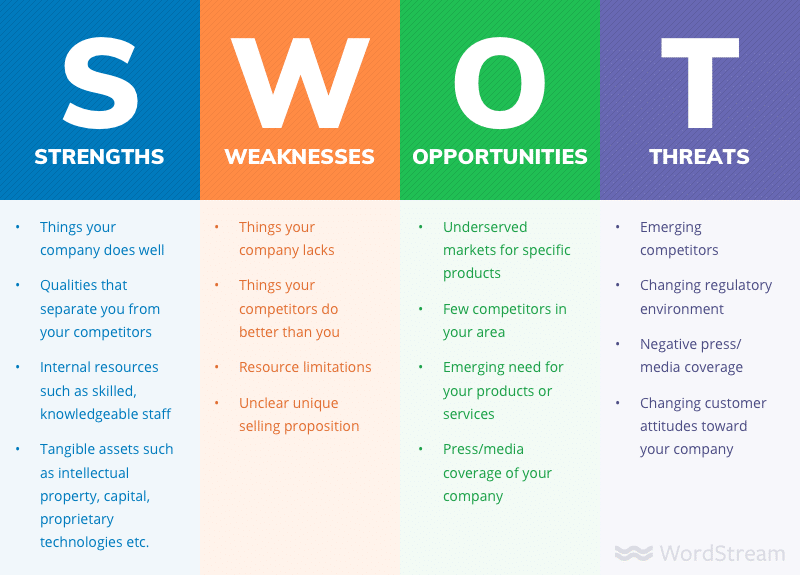

1. SWOT Analysis

Simply put, a SWOT analysis is a strategic technique used by businesses to uncover their strengths, weaknesses, opportunities, and threats. By performing SWOT, you’ll be able to anticipate your competitor’s next move better and look to internal problems and successes within your company,

2. Competitive Matrix

Competitive matrices help you organise the data you’ve found on competitors and your market into a clear, simple format. Depending on what type of matrix you choose to compile, you’ll also be able to benchmark your own company’s product and business data against that of the competition. Mapping out your successes and pain points can act as a handy reference when making decisions.

Some matrix formats include:

- Feature comparison matrices (displays your competitor’s products, features, and data)

- Competitive quadrants (organises each of your competitors into four sectors: leaders, challengers, niche players, and visionaries)

- Win/loss matrices (offsets your business strengths against your business weaknesses)

3. Win/Loss Analysis

Ideal for giving you an overview of your sales wins and losses, conducting a win/loss analysis will provide insight into internal and external operations. While it can help map out your own sales wins and losses, you’ll also be able to use it to map out your competitor’s sales wins and failures within a specified time frame.

Remember to focus on your win rate and the overall picture (your competitive win rate and failures, too). Segmenting and mapping out all the internal and external data like this will clearly visualise how you’re performing compared to your competition.

4. Competitive Battlecard

Acting as snackable content and a point of reference for your sales team, a Battlecard will help you understand your competitive market better and give pointers how to deal with sales calls. All in all, Battlecards comprise short but actionable information detailing your competitor’s products, strengths and weaknesses, as well as potential opportunities for you to compete.

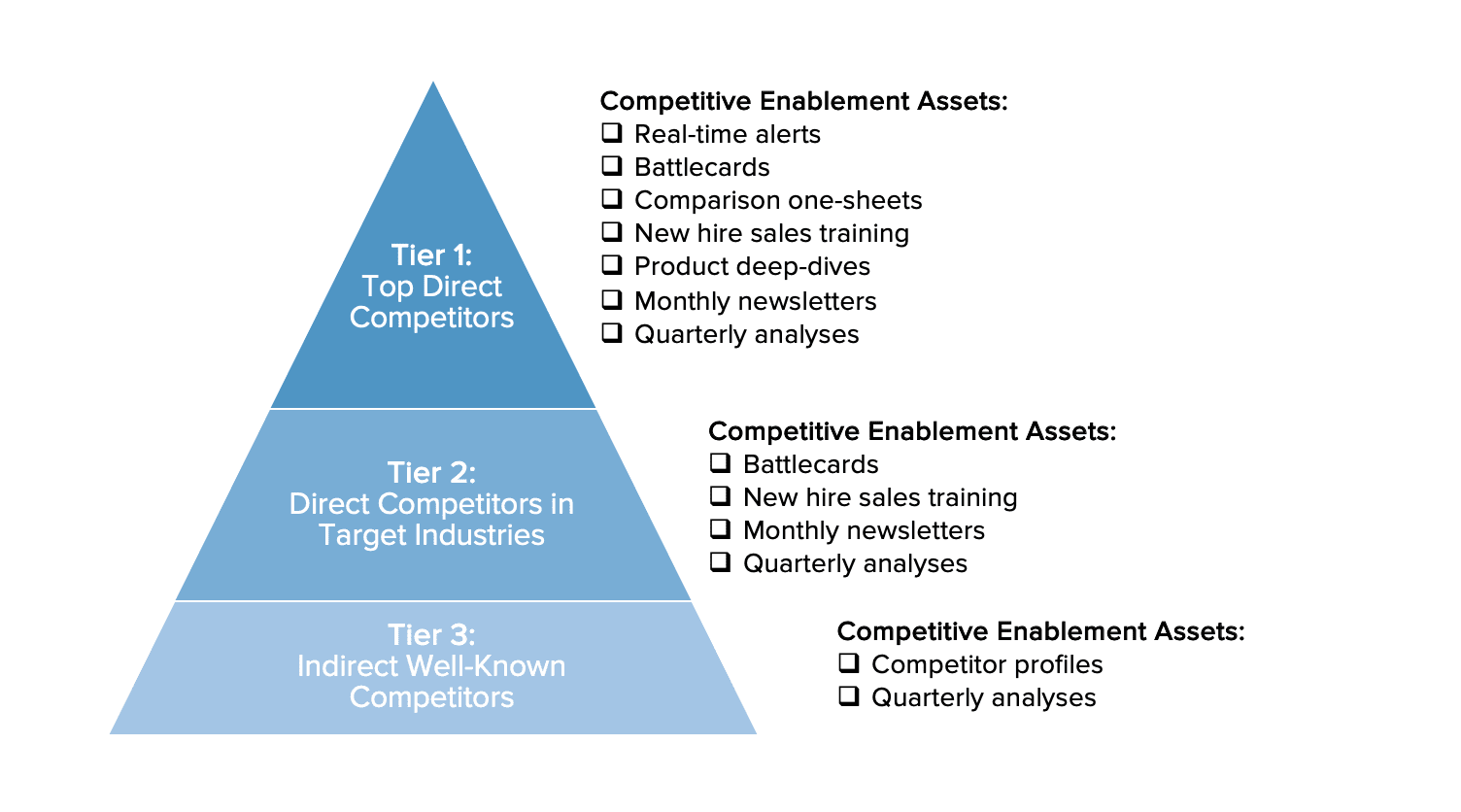

5. Business Pyramid of Competitive Landscape

Essentially a visualisation of your business’s competitive landscape, this pyramid is broken down into three main tiers: top direct competitors, direct competitors in target industries, and indirect well-known competitors.

Each of these three tiers focuses on your competitor’s sales enablement assets (this could be anything, ranging from monthly newsletters and product deep-dives to analysing competitor profiles). Simply put, the pyramid is a clear breakdown of the competition you face in your industry, giving you a framework from which to analyse CI.

Takeaway

A successful competitive intelligence program is more than just collecting and analysing the data. Though the tools and techniques you adopt to source data are important, it’s key to remember that CI should be actionable. It would be best to use everything you take away from the data and your insights to inform decision-making and incorporate new business strategies.

It’s never too late to begin implementing CI programs, so take the first step and combine the tools and techniques we’ve listed to supercharge your strategy. Whatever industry you’re in, it’s key you create a strategy that also puts your customers at the heart of its operations. With RingCentral for Retail, you’ll be able to provide a seamless CX—all from one communications platform. For more information on how RingCentral for Retail can help you create memorable customer experiences, click HERE!

Originally published Jul 08, 2021, updated Apr 10, 2023