In this article, we'll cover:

What is a Purchase Order?

A purchase order (PO) is an official document a buyer sends to a seller. The purchase order binds the buyer to a promise to pay the seller for designated products at a future date. The purchase order form itself specifies the types and quantities of each product.

Purchase orders are beneficial to both parties involved. They help sellers by guaranteeing the future safety of their cash flow since any PO counts as a legal document that requires the buyer to pay for the products they receive.

Sellers can be certain that they won’t be over – or under-producing any products, as the details in every purchase order request they receive tell them exactly what quantities of each of their products they need to manufacture.

POs also help buyers by giving them precise control over the quantity and specifications of any given product they will be receiving. At the same time, POs are a useful way for buyers to keep track of their order details, which helps to simplify the auditing process.

How do purchase orders work?

A purchase order counts as a binding contract. This means that sellers are protected from the risk of buyers backing out of a deal or refusing to pay for a product, while both parties have legal protection against scammers.

Purchase orders essentially work by clearly defining a buyer’s procurement process. They do this by being the means through which a buyer communicates directly to a seller which products they are after, and in what quantity. This greatly simplifies the task of procurement as a whole.

Steps in the purchase order process

The precise steps that make up the purchase order process are as follows:

- The buyer makes a note of which product(s) they will be purchasing for their business, then chooses a company that sells that product.

- The purchasing department of the buyer’s company sends a PO to the seller. This PO serves as a purchase requisition. It contains details regarding the delivery date for the product(s), as well as the pricing for all chosen products.

- Once the seller has checked that they are able to fill the order, they confirm this with the buyer. If the seller is unable to fill the order, the PO is cancelled and the purchasing process is terminated.

- The seller prepares and ships the order, ensuring that they comply with the due date specified in the PO. The PO number is included on the packing list for the buyer’s convenience, as this helps them keep track of the audit trail.

- The seller issues an invoice to the buyer. Since the payment terms were set out in the PO, this process is streamlined and simple. The seller will often already have the details of which specific company credit card the invoice will be billed to, for example.

- Using the payment method detailed in the PO, the buyer pays the invoice.

Who issues a purchase order?

The short answer to this question is that buyers issue purchase orders. The longer answer is that many different kinds of companies can play the part of ‘the buyer’ in this scenario. That means any business that requisitions supplies, products, or services from other companies may issue purchase orders.

For example, most companies that are affiliated with the retail sector would have a purchasing department in place that manages the purchase order system for the company. Of course, a small business or new startup might not have a dedicated department. They would typically have a smaller team or group of individuals that procure necessary resources.

The important thing to keep in mind with regards to who issues a company’s purchase orders is that a specialised team takes care of this, rather than the business owners themselves.

What does a purchase order contain?

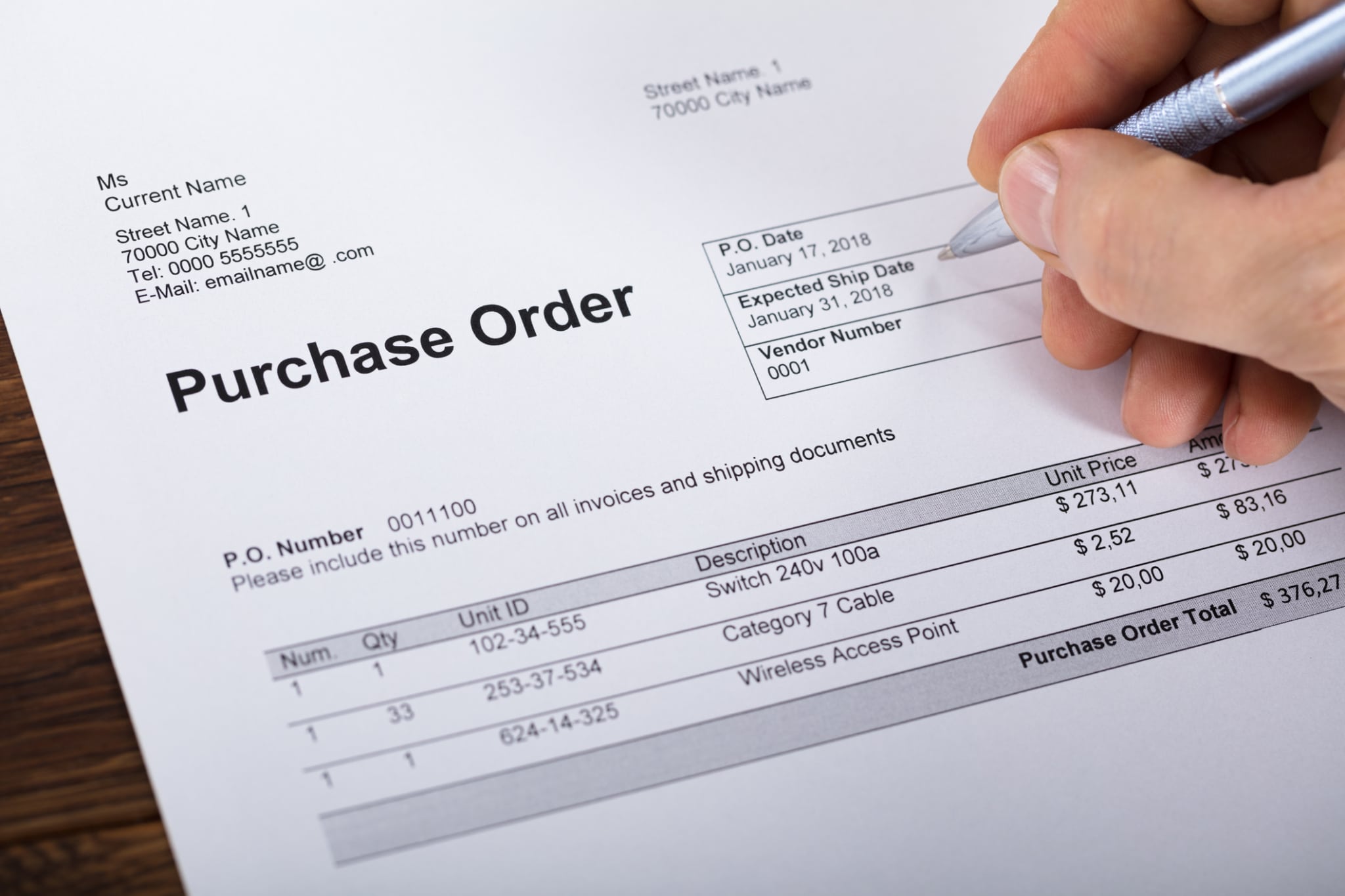

While there are various types of purchase orders, each of them are full of similar types of content. Every purchase order has details about the product(s) that are being ordered, including quantity, SKU, date of delivery and price (generally including VAT).

Purchase orders will typically also contain details regarding the accounts payable process, such as whether the order in question is to be one-off or continuous over a set amount of time.

They also include a purchase order number, which helps with future invoicing by letting a PO be matched up with its corresponding invoice number.

Lastly, POs contain shipment details, so the seller knows where to send their product(s).

Purchase order vs invoice: What’s the difference?

Put simply, buyers issue purchase orders, while sellers issue invoices. Invoices are also typically for products that have already been shipped, or for services that have been carried out. Purchase orders concern future services or products.

Buyers that issue POs have to ensure that their future budgeting takes the payment of these orders into account. Invoices, on the other hand, are a concern for immediate budgeting, as they must be paid once the seller has issued them rather than on receipt of a product (in the future).

Why you need to automate the purchase order process

Automating the PO process allows finance departments to process the details on electronic purchase orders more easily, which helps those departments to run more smoothly. This is because the process of managing the details on POs can be automated, thereby saving resources and allowing employees to focus on other areas.

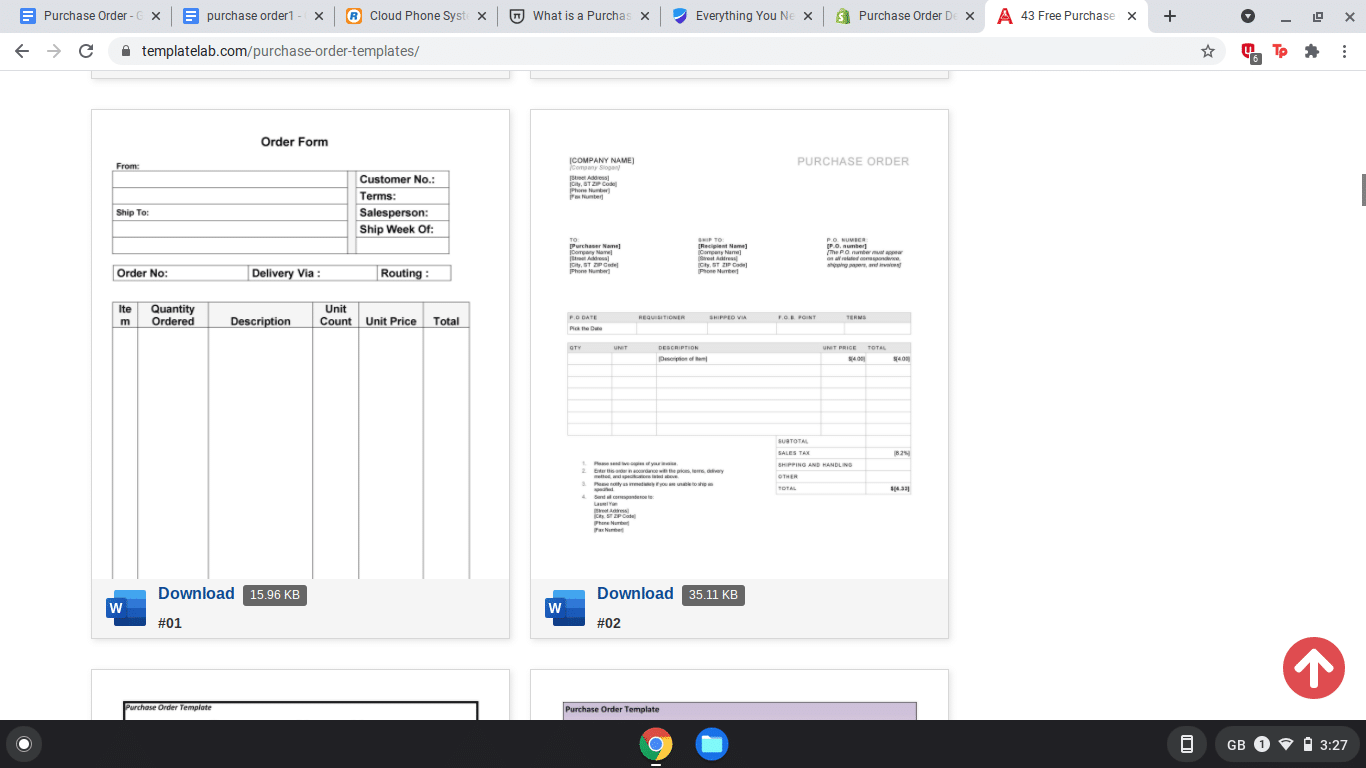

An automated PO process relies on a solid purchase order template that’s filled in automatically whenever an order is required. This simplifies the process of making blanket purchase orders, as the automated service will ensure that repeat orders are handled correctly.

Using POs to improve the customer experience

POs streamline the workflow of companies, which maximises the efficiency of the business itself and boosts customer experience. Exemplary customer experience is a vital consideration for all retail businesses.

When automated PO systems are already helping your business to run more smoothly from the inside, it’s time to look at improving the way your business appeals to customers on the outside. Find out how a RingCentral cloud phone system can help your business achieve just this.

Originally published May 27, 2021