In this article, we'll cover:

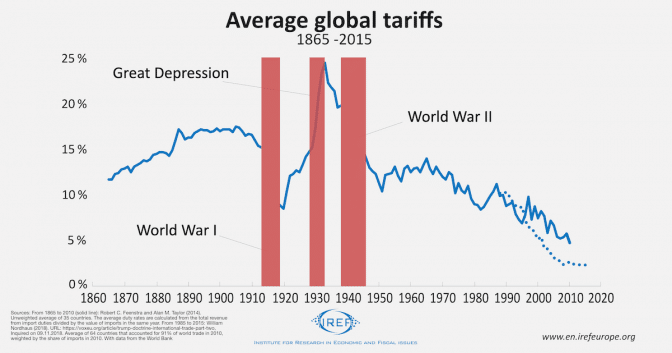

With Brexit, the Coronavirus pandemic and the 2021 Suez Canal obstruction, it’s clear why trade has been incredibly prevalent in the mainstream media for the last couple of years.

In 2019, the total annual value of imported goods into the UK was just under $700 billion, and this sum has been fairly consistent since 2012. The COVID pandemic highlighted the importance of importing when the Prime Minister announced that ‘closing the borders would be impractical given the number of medicines and food imported into the country.

In this article, we will be exploring what tariffs are and why they exist and looking at the new laws and regulations concerning them.

What is a tariff?

Essentially, a tariff is a form of taxation that is applied to most foreign goods. Think of it like customs duty but on a more national scale instead of an individual consumer level. Money obtained from this tax is collected by HM Revenue & Customs.

Tariffs can sometimes be confused with quotas. A tariff is a tax, meaning a percentage added to an infinite amount. In comparison, a quota is a specific and predetermined quantity limit. Tariffs are easier to apply. They are more transparent, allowing trading partners to renegotiate their trade deals and lower tariff rates.

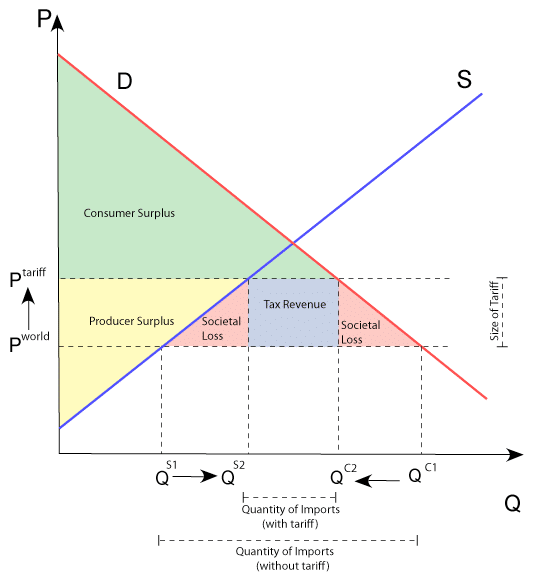

The idea behind these taxes, or any tax, in fact, is to discourage the related act. Constantly importing goods from abroad can bring a high level of foreign competition which can affect domestic industries. This can have both negative and positive effects, but we will discuss this further below.

Why do tariffs exist?

The World Trade Organisation (WTO) says that tariffs provide an economic advantage for nationally or locally produced products. Let’s have a look at this in more detail. Here are the main reasons why import tariffs exist:

1. Conserving employment

Consider this scenario. You’re a restaurant owner in the UK, and it goes without saying that customer experience is of the utmost importance to you. For that reason, you decide to make trade agreements with some meat importers to reduce the customer cost price. But, what you’ve actually done is take away a job for your local farmers.

Not only that, a lot of exporters can provide these low prices due to a lack of government regulation and by potentially underpaying workers in that country.

When high tariffs and import duties exist, it deters businesses, such as the restaurant from our example, from solely relying on these external sources.

2. Ensuring safety and regulation

Customs tariffs can also be used to provide regulation and protection to that country’s citizens. If a nation believes that a certain product can potentially harm its consumers, higher tariff rates will be put into place.

Examples include tariffs on cigarettes, alcohol, or even food if authorities suspect that the hygiene standard is low and an increased probability of disease.

3. Political manipulation

Tariffs don’t just affect the employment of domestic industries. If a government increases the tariff of a specific product imported from a certain country, domestic industries will stop purchasing it abroad and source it elsewhere. This harms that foreign country’s economy. This means that tariffs can be used for political leverage.

For example, Stilton cheese can only be named ‘Stilton’ if produced in Derbyshire, Nottinghamshire, or Leicestershire. If the UK government heard the news that the Netherlands were allowing their cheesemakers to produce ‘Stilton’, in retaliation, the government would ask the UK’s department for international trade to increase tariffs on products coming from the Netherlands. This reduces the Netherlands’ exporting ability and will cause them to rethink their cheese policy.

4. Industry protection

Tariffs can also be beneficial for a country that wants to develop its economy and specific industries.

Applying tariffs to certain foreign products can allow infant industries to thrive, as there is less competition from external sources. Of course, this strategy only works if the government subsidises these infant industries and ensures that their lack of competition doesn’t result in reduced product quality.

Let’s look at the effects of tariffs:

- Government – tariffs result in a direct increase in government revenue. But, with import tariffs going up, local industry prices can go up, which means that disposable income for citizens may decrease. This can reduce the amount of taxes the government collects from other sources.

- Employment – tariffs can increase employment. But, if another country imposes tariffs on your country, your export rate reduces. So, this may reduce employment. And as we mentioned above, higher tariffs could mean less disposable income for consumers, which means less spending, which means companies could go out of business.

- Producers – local industries will benefit as they do not have to compete with cheaper products. But, this can result in complacency and reduced quality or overpriced products.

What tariffs apply to

Tariffs are subject to the discretion of the specific country. This means that they can be applied to certain goods, depending on the country’s economic (and political) preferences. But, the majority of nations are part of the World Trade Organization. This allows countries to sign free trade agreements.

Also, nations have the option to form customs unions. These agreements allow nations that are members of any union to trade freely without worrying about import tariffs. Also, customs unions use a common external tariff for all imports from external nations. An example of this is the European Union.

Here are some of the most prevalent types of tariffs:

- Specific Tariffs: This is when a nation applies a fixed tax on specific goods. This can be done per item or by any predetermined amount. For example, a £100 tariff on every one laptop imported.

- Ad Valorem Tariffs: This type of tariff is the one we are more familiar with and calculated based on value. Ad valorem is a Latin phrase that means according to value. For example, if the government decides a 5% tariff on tech equipment, a company importing £10,000 worth of such equipment would pay an additional £500.

- Tariff Rate Quotas: This is a scheme that governments apply to allow businesses to import a specific amount of a certain product at a lower tariff rate. Once that quota has been met, the import duty rate increases.

Coronavirus pandemic tariffs

Tariffs can also be adapted to times of crisis or anything of an unprecedented nature. An example of this is the COVID-19 pandemic.

In the UK, the government suspended import tariffs on products used to fight COVID-19, including face masks, medicines, gloves, and other protective measures. This was also mimicked throughout the world and allowed for efficient distribution.

How to check tariffs

The method for checking tariffs is dependent on your country. In the UK, we use the commodity code system, and in the EU, they use the TARIC code.

Commodity codes are ten-digit numbers that allow you to immediately identify goods and separate them into categories that will enable you to work out the correct tariff required. You have the option to search for the commodity code, product description, or even both at the same time. The tariff rates shown via the commodity codes do not include:

- VAT

- Anti-dumping

- Countervailing

- Safeguards

Here are a couple of examples:

- Furskins – the commodity code for furskins is 4302301000. According to the UK government website, furskins are subject to a third country duty of 2%. This means that £5000 of fur skins would incur an additional £100 tax.

- Headgear – the commodity code for headgear is 65010000. According to the UK government website, headgear is subject to a third country duty of 4%. This means that £50,000 of headgear would incur an additional £2000 tax.

A few more tariff calculation details

It’s also important to note that the UK government has simplified and liberalised some tariffs. Here’s what that means:

- Liberalised – this is the process of reducing a tariff down to zero.

- Simplified – this is the process of rounding down the decimal point of the tariff, meaning that they will only appear as a single digit. This allows for a more straightforward calculation.

Tariffs are calculated at set exchange rates. For example, €1 is set at 0.83687 GBP. Also, when a tariff is calculated, if the sum taxation is equal to or higher than £10, it is rounded to the nearest £1. Anything under £10 is rounded to the nearest 10p.

What tariffs will apply in the UK?

From the 1st of January 2021, the UK switched from a Common External Tariff (CET) with the EU to a UK Global Tariff (UKGT) due to Brexit. This has resulted in changes to what tariffs the UK will now apply.

Overall, import duties are looking to be decreased. Under the CET, around 30% of all goods are taxed, whereas, under the UKGT, almost 50% of products will be tariff-free. In addition, the average import duty tax will be reduced from around 7% under the CET to 5.7% under the UKGT. This reduction is due to the liberalisation and simplification of tariffs.

However, in some scenarios, the UKGT will not apply. These include:

- With nations that the UK already had an existing trade deal with

- With nations that are members of the UK Generalised Scheme of Preferences such as Australia, Canada, Japan, United States of America, etc.

- If there are unprecedented circumstances or any relief requirements, such as COVID-19 pandemic protective equipment.

It’s clear to see from the reduced tariffs that the UKGT will positively impact businesses that rely on importing products from outside of the EU. But, we will have to see whether the UKGT will positively affect business as a whole in the UK.

To sum up

Tariffs are an essential part of global trade. They allow governments to increase their revenue opportunities, control imports and support local industries. With the current times and UKTG being in its infancy, business owners need to keep up with any tariff rules or regulations changes.

As you’ll now know, tariffs can affect businesses in all niches. If you’re in hospitality, they’re just one of many things to worry about right now. Why not ensure that your communications aren’t added to that list by investing in a top-class phone system?

Originally published Jun 03, 2021